Savings rate is the % of your income that you save. A common number is 10%. This number is wrong.

First, you need to spend less than you earn. Second, there is no magic savings rate. Having a higher savings rate benefits you in two ways:

- you have a lower cost base, so you learn to live on less and,

- more savings means more capital to reach your goals.

The actual savings rate number doesn’t matter. 10% is OK, 30% is good. What matters is knowing your savings rate and knowing how it’s changing. Savings rate is a good leading indicator of lifestyle creep and an increasing cost base. Just knowing your savings rate will give you a big insight into your personal financial position. Being able to track your savings rate over time is powerful.

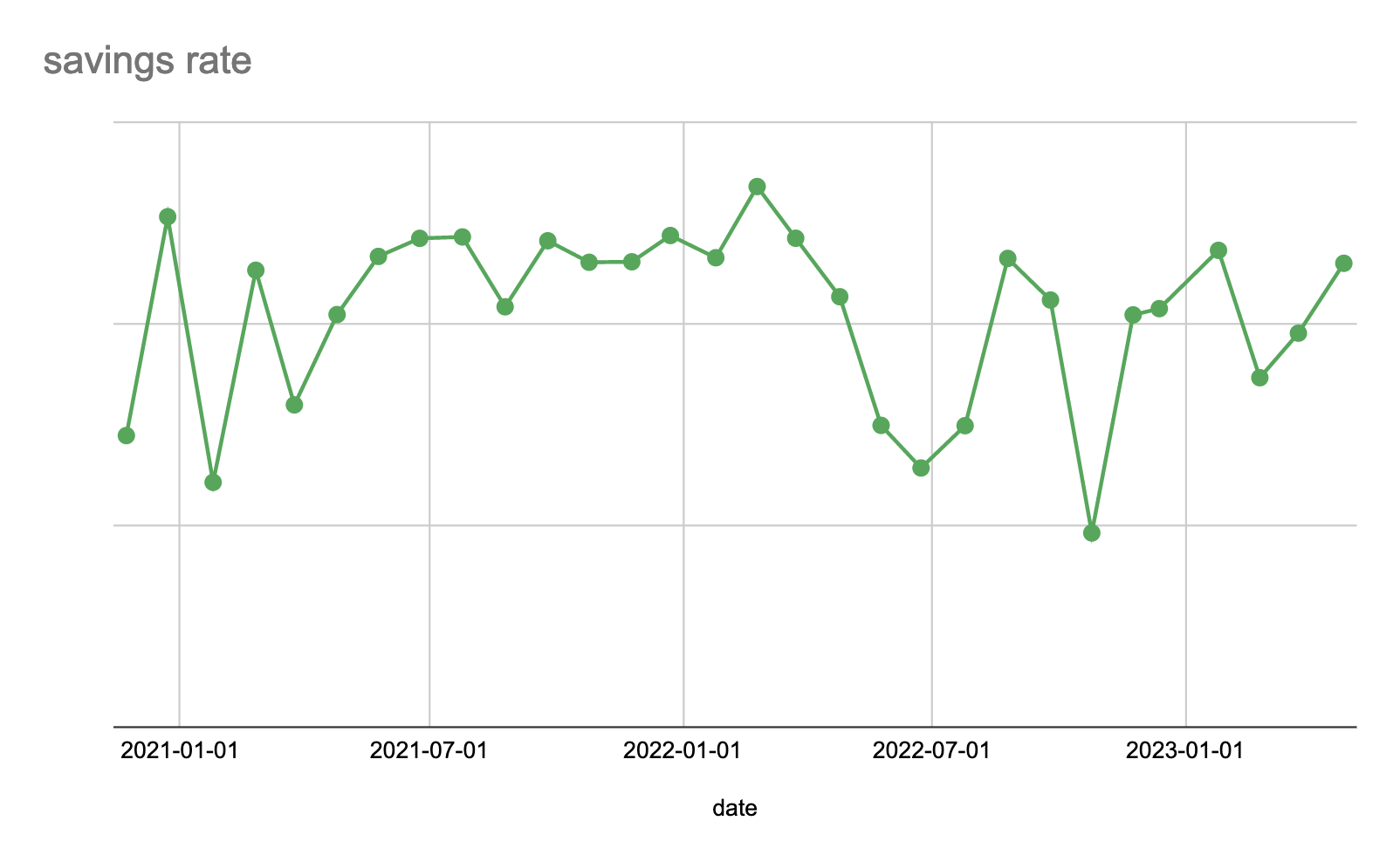

This is my savings rate for more than 2 years. The actual numbers aren’t that important, so I’ve omitted them. What I can see from this is when I am spending more than I should, when I’m hitting my goal savings rate, and when I’m exceeding it. I can also see how I’m doing over time.

The thing about a static number savings rate is that it’s smoothed. We all know some months we spend more and some we spend less. But a smoothed savings rate % doesn’t take this into account.

Targeting a specific % of income as a savings rate doesn’t take the bumpiness of spending into account. But I can easily see the bumpiness by tracking the rate over time. For example; I tend to spend more at Christmas, and in September.